|

|

In order to build processes with long memory, a set of (historical) volatilities are computed over increasing time horizons. Each historical volatility is measured by an exponential moving average (EMA):

The time structure lk of the process is a geometric series lk = ρk-1. The time horizons τk correspond to the characteristic times of the EMA at which the historical volatility is measured. The usual parameters μk entering in the EMA are related to the EMA time scales τk with the second equation. The last equation computes an historical volatility using an EMA (exponential moving average) of the returns at the shortest time horizon δt.The effective volatility is defined by:

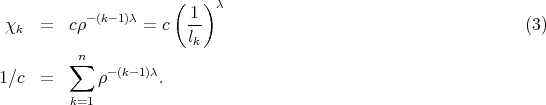

The coefficients χk are such that ∑ χk = 1 and ∑ wk + w∞ = 1. They are defined with a simple function, so as to obtained the desired decay for the volatility lagged correlation. For a power law decay:

The simulation uses a power law decay for the coefficients, with parameters:

The innovations have a Student distribution with 3.3 degree of freedom. The simulation time corresponds to 200 years with a time increment δt = 3 minutes.