|

|

The mean volatility σ∞ and coupling constant w∞ are important parameters for all the affine ARCH processes, and the mechanism that sets their values is an interesting open question.

A possible explanation that the fundamental economic shifts induce price moves, and the term w∞σ∞2 is a measure of the underlying economic activities and/or imbalances. In this explanation, the mean volatility level is set by long term economic fluctuations, with a dynamics given by a stochastic volatility process. Then, the dynamics of the financial markets is captured by an ARCH process.

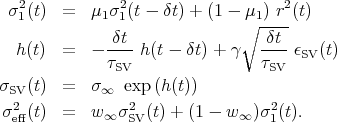

The simplest process combining a long term exponential stochastic volatility with a short term GARCH(1,1) process is the following:

The argument about the long term economic fluctuations would lead to τSV > τk.

The parameters have been chosen so as to visualize clearly the generic properties of a combined process. They are

The innovations have a Student distribution with 3.3 degree of freedom, while the innovations ϵSV for the stochastic volatility have a normal distribution. The simulation time corresponds to 200 years with a time increment δt = 3 minutes.