|

|

The general motivation for mixing a stochastic volatility mean with a GARCH structure for the volatility feed-back is presented for the GARCH(1,1) process with a stochastic volatility mean.

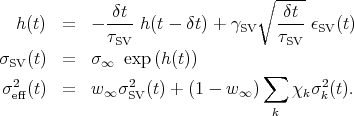

The present process uses a long memory aggregated ARCH for the volatility feed-back component. The equations for the ARCH volatility components σk are described in the page for this process and in microscopic ARCH process for the parameters χk. The combined volatility equations are as follow:

The parameters have been chosen so as to have statistics close to the empirical ones, with a power law decay for the coefficient χk. They are

The innovations have a Student distribution with 3.3 degree of freedom, while the innovations ϵSV for the stochastic volatility have a normal distribution. The simulation time corresponds to 200 years with a time increment δt = 3 minutes.